- #PAYPAL LOGIN MY ACCOUNT STATEMENT HOW TO#

- #PAYPAL LOGIN MY ACCOUNT STATEMENT FULL#

- #PAYPAL LOGIN MY ACCOUNT STATEMENT VERIFICATION#

- #PAYPAL LOGIN MY ACCOUNT STATEMENT PASSWORD#

- #PAYPAL LOGIN MY ACCOUNT STATEMENT ZIP#

We cannot attempt to initiate any transactions.

#PAYPAL LOGIN MY ACCOUNT STATEMENT PASSWORD#

While your username and password are initially used to log into your account and download your transactions, they are not saved in our database.

#PAYPAL LOGIN MY ACCOUNT STATEMENT ZIP#

Zip has a strictly 'read-only' view of your transaction information. Your login information is never displayed anywhere or accessed by human eyes.Ĭan Zip use my login information to access my bank accounts and make transactions? Your login information is passed securely to your bank to gain ‘read only’ access to your transaction history. Since 2013 they have provided secure, automated data retrieval services to over a quarter of a million Australians as part of their credit applications.ĭo you store my bank login information on your servers?

#PAYPAL LOGIN MY ACCOUNT STATEMENT VERIFICATION#

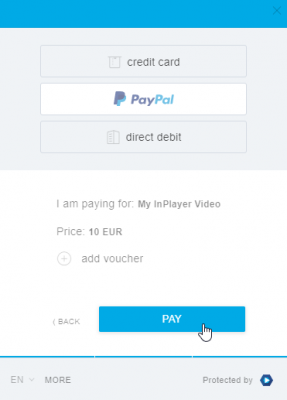

Zip's Instant Verification Service is powered by, the Australian leader in automated bank statement data retrieval. This includes your income, rent or mortgage payments. Zip uses information related to your bank account to make a fast lending decision by verifying the information you've provided. Why does Zip need me to connect to my bank account? However, if we have specifically asked you to link your bank account, you must be able to connect to one in order to continue your application. In our example, this would be £2.If you have selected 'Connect a Bank' as an ID verification option, you can go back and connect with PayPal. Consider adding the customer name or sales invoice number as a reference so you can see what the fees were for.Įnter the amount of the fee. In our example, this is £12.įrom the PayPal bank account, create a new Other Payment for the amount of the fees. Select the payment using the check box to the left.ĭiscard the payment using the Bin icon at the top of the page.įrom Banking, open the PayPal bank account and create a new Customer Receiptfor the total value of the invoice, and select the invoice to pay.

In our example, the amount outstanding on the invoice will be £10. This reduces the outstanding amount on the invoice. Match the payment from PayPal to the invoice from the bank feed. This could be Bank charges and interest or the new nominal account you have created. There are three ways to record money received from the customer and the fee charged by PayPal. In our example, this would be for £2.Ĭhoose the category to record your PayPal fees. Open the sales invoice you want to pay from Sales, then Sales invoices.Įnter a line for the amount of the fee.We're taking you to PayPal Checkout to complete payment. We recognise you on this device, so you can skip login. Matching a credit to the invoice first, reduces the outstanding balance and allows you match the payment from PayPal. We've recognised you on this device, so you don't need to enter your password for this purchase. This could be Bank charges and interest or the new nominal account you have created.Įnter the amount of the fee. Select the Make adjustment option next to the Left to Match total.Ĭhoose the category to record your PayPal fees.In our example, this will match £12, leaving £2 left over. From the bank feed, choose Match on the payment from PayPal.

This allows you record the payment and the fees directly from the bank feed at the same time. Paypal deducts a £2 fee, sending you £10.

#PAYPAL LOGIN MY ACCOUNT STATEMENT FULL#

Match the payment from PayPal to the invoice from the bank feed and add an adjustment for the fee.Ĭreate a credit note for the amount of the fee, then match this and the payment from PayPal to the invoice.ĭiscard the payment from PayPal from your bank feed and create two new transactions a Customer Receipt for the full value of the invoice and an Other Payment for the fee. There are three ways to record money received from the customer and the fee charged by PayPal. You could record them using an existing category such as Bank Charges, or create new category specifically for PayPal fees.Īny new ledger account would need to be an created as an Overhead and be visible in both sales and purchases. Things to considerĬonsider where you want to record the fees paid to PayPal.

#PAYPAL LOGIN MY ACCOUNT STATEMENT HOW TO#

This explains how to match these receipts to invoices. PayPal (UK) is also supported via bank feeds however unlike a standard bank feed, transactions imported from PayPal already have fees deducted from each transaction.

0 kommentar(er)

0 kommentar(er)